The Company adopts a risk philosophy aimed at enhancing shareholder value by sustaining competitive advantage, managing risks, and enabling the pursuit of strategic growth opportunities with greater speed, skills and confidence over its competitors.

To put this philosophy into action, the Board, through its Board Risk Oversight Committee, adopted an Enterprise Risk Management (ERM) system that ensures all business risks are identified, measured and managed effectively and continuously within a structured and proactive framework. The Company’s ERM is based on the Committee of Sponsoring Organizations of the Treadway Commission-ERM framework. Values and standards of business conduct and ethics are important elements of the internal environment for risk management.

Enterprise Risk Management Program

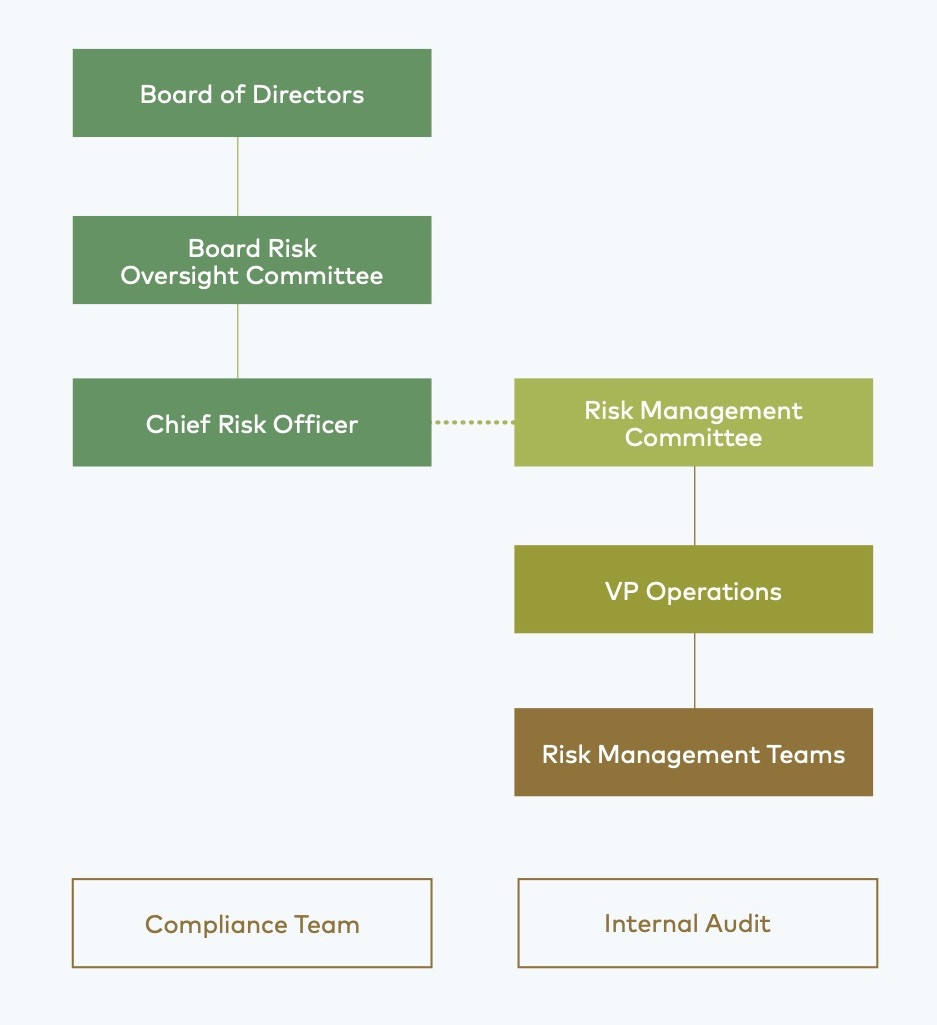

Risk Management Structure

The Board, through its Board Risk Oversight Committee, has responsibility for overseeing risk management within the Company. Assisting the Board is the Chief Risk Officer (CRO) who, in turn, is supported by the Risk Management Committee. The Risk Management Committee is responsible for ensuring that all significant risks are managed adequately. The Company CRO reports significant risks and related risk strategies to the Board Risk Oversight Committee and the status of the risk management initiatives on a regular basis.

In addition to the risk management teams, a cross-functional group composed of personnel with technical, financial, and legal expertise review the Company’s compliance with mining laws and regulations. The Internal Auditor reports to the Audit Committee, the results of the review of the effectiveness of risk management strategies and action plans adopted by management.