The amount of P3.1 billion — represents the local and national taxes; taxes withheld from Employees' salary, suppliers and providers.

The amount of P3.1 billion — represents the local and national taxes; taxes withheld from Employees' salary, suppliers and providers.

About P96 million were spent for the Social Development and Management Program (SDMP) and P141.7 million for the Environmental Protection and Enhancement Program (EPEP).

Over-all, NAC-CMC pays an average of P343 million per year or 22 percent of its total gross revenue, for taxes and other regulatory fees to both local and national government.

This is in stark contrast to allegations of anti mining advocates that mining results in very little tax payments to the government.

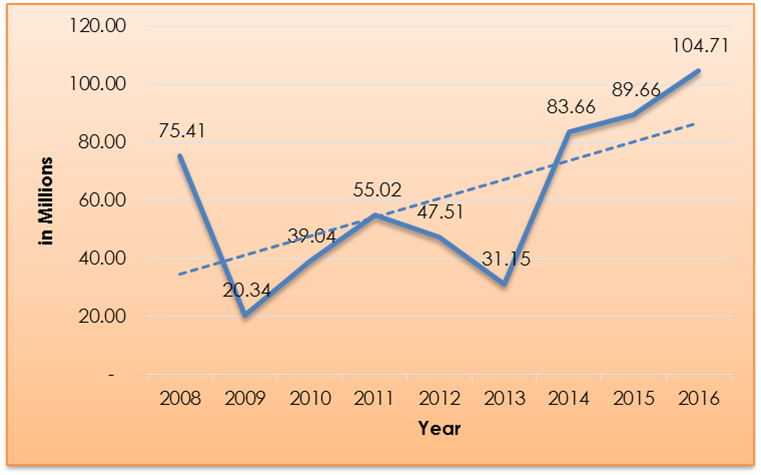

Last year, NAC-CMC paid over P297.8 million in national taxes, P40 million in local taxes, and P104.7 million in taxes withheld.

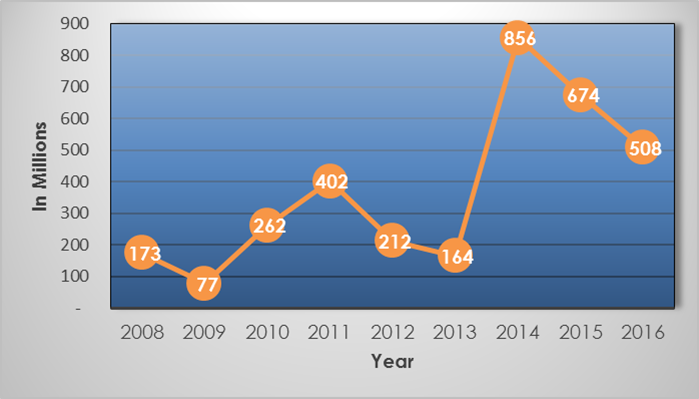

The substantial tax payment that NAC-CMC paid was in 2014, when it disbursed a total of P727.8 million for taxes to the national government.

National taxes include corporate income tax (30 percent of the net taxable income), excise tax (2 percent of the gross revenue), mineral reservation royalty (5 percent of the gross revenue), customs duties, documentary stamp tax and other national taxes.

Likewise for local taxes, the highest recorded payment of NAC-CMC was in 2015 when the company paid a total of P48.9 million of which P28.6 million was significantly attributed to the local business tax paid directly to the municipality of Cagdianao.

Moreover, local taxes also include real property tax; occupation fees; wharfage fees paid to the local office of the Philippine Ports Authority; and other local taxes and fees.

Aside from taxes paid directly to local coffers, local government units also get a 40 percent share from the 2 percent excise tax paid to the national government. In 2016, Department of Budget and Management (DBM) placed the total LGU mining share at P233.8-million.

According to the Department of Finance, the closure of 28 mines as ordered by the Department of Environment and Natural Resources (DENR) recently will result to a loss of P650 million yearly in foregone revenues.